Know How Transfer

Integration of SAP GTS and SAP EWM in the Goods Issue Process

SAP Extended Warehouse Management

SAP Global Trade Services

Customs clearance is required for the delivery of goods to a third country. With SAP GTS, companies can autonomously handle this process through electronic export declarations. If the company also uses SAP S/4HANA and SAP EWM in addition to SAP GTS, the customs processes can seamlessly be integrated into the goods issue process.

In this article, we will explain how you can carry out the export process with direct integration of SAP EWM, SAP GTS and SAP S/4HANA.

Caution: Agreements established between the company and customs authorities, based on authorizations, can further simplify the export process.

Process Flow with SAP GTS and SAP EWM

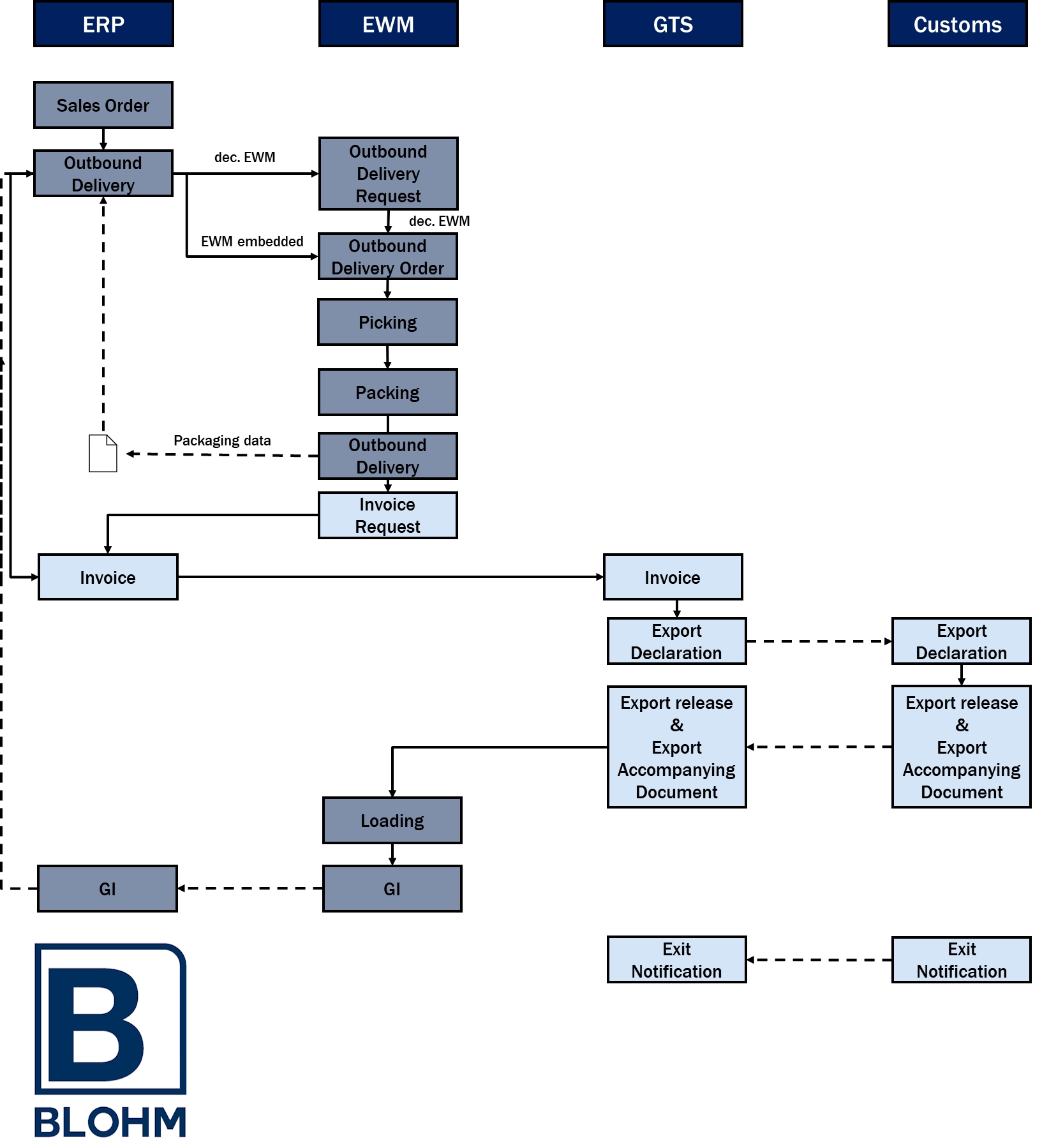

The goods issue process for an export process with the integrated systems SAP S/4HANA, SAP GTS and SAP EWM is as follows:

The export declaration is based on an invoice. In SAP S/4HANA, invoices are usually created after the posting the goods issue. However, since the export must be completed prior to the goods issue, the invoice needs to be created beforehand. Therefore, companies can use pro-forma invoices, which can be created based on the outbound delivery before the goods issue. Alternatively, they can also use the best-practice approach of creating invoices before goods issue (IBGI), which is explained here.

The postings and process flow are explained in detail below.

1. Creation of a Sales Order (S/4HANA)

A customer with a delivery address in a third country places a sales order for goods from your company. You process the order in your system by creating a sales order and confirming it.

2. Outbound Delivery (S/4HANA - EWM)

Once the delivery date is reached and the ordered goods are available, an outbound delivery is created based on the sales order, either manually or by collective processing. This delivery is then transmitted to the SAP EWM system, where it serves as the foundation for subsequent warehouse processes. If a decentralized SAP EWM system is used, an outbound delivery request is initiated in SAP EWM based on the outbound delivery, triggering an outbound delivery order. In an SAP EWM embedded in SAP S/4HANA, the outbound delivery order is created directly without the need for a separate outbound delivery request.

3. Picking (EWM)

During picking, the items required for the customer order are taken from their respective storage bin and staged for packing.

During picking, the items required for the customer order are taken from their respective storage bin and staged for packing.

SAP EWM generates picking warehouse tasks based on the outbound delivery order.

These are then bundled by SAP EWM into warehouse orders. The warehouse order is the work package for the resources in the warehouse, e.g. people picking the goods from the rack. The warehouse tasks contain the articles of the outbound delivery order and their respective quantities to be picked from the storage bins in order to fulfill the sales order.

4. Packing (EWM)

The picked items are then packed into appropriate packaging materials according to the shipping specifications.

5. Outbound Delivery (EWM - S/4HANA)

After packing is completed, the outbound delivery is created in EWM. This updates the outbound delivery in SAP S/4HANA, including the transfer of packaging data. Consequently, the packaging data required for the export declaration is available in the outbound delivery in SAP S/4HANA and can be transferred to the export declaration via the invoice in the subsequent steps.

6. Invoice Request (EWM - S/4HANA)

Upon completion of packing, an invoice request is transmitted from SAP EWM to the SAP S/4HANA system.

Depending on the configuration, invoices can be generated either per outbound delivery or per shipment (i.e., the contents of a vehicle or transport unit). Since the export declaration is created for each invoice, it makes sense for companies to create just one invoice per goods recipient in case of multiple outbound deliveries.

7. Invoice (S/4HANA - GTS)

The invoice request from SAP EWM triggers the creation of an invoice. The invoice is created as an invoice before goods issue (IBGI) in SAP S/4HANA, based on the outbound delivery. If the countries’ combination between the sender and the recipient is relevant for export, the invoice is forwarded to SAP GTS.

8. Export Declaration (GTS - Customs)

SAP GTS automatically generates an export declaration in response to the invoice received from SAP S/4HANA, considering existing authorizations, such as those for simplified procedures. All necessary information for the customs declaration is taken from the previous documents. The export declaration is checked by the processor, and if required, adjustments are made before it is electronically transmitted to customs via the system interface.

If export licenses are applicable, they are found and copied into the export declaration, to notified customs. The same procedure applies to other documents, such as binding tariff information.

9. Export Release & Export Accompanying Document (Customs - GTS)

Upon customs verification of the export declaration, the company typically receives an export release and the corresponding export accompanying document within a short timeframe, particularly for simplified customs declarations. This allows the consignment to be shipped.

The accompanying document must physically accompany the consignment to the border of the European Union, serving as proof of export permission. The document contains the MRN (Movement Reference Number), enabling EU customs authorities to identify the consignment at any point during transportation.

10. Loading (EWM)

After receiving the export release and attaching the export accompanying document to the shipment, it is ready to be loaded onto the pick-up vehicle.

11. Goods Issue (EWM - S/4HANA)

Following the completion of loading, the pick-up vehicle departs from the warehouse, and the goods issue can be posted. The goods issue information is automatically transmitted to the SAP S/4HANA system, where it updates the outbound delivery and triggers stock postings as well as the creation of accounting documents.

Follow-up Process

The customs process concludes upon the consignment has left the EU. To facilitate this, the export accompanying document is presented at the customs office of exit, situated at the external EU border, where the goods are presented for a second time. Subsequently, customs authorities register the departure of the goods from the EU customs territory, confirming their export status. The export accompanying document is cleared and the goods are released for exit. The customs authorities then transmit an electronic exit notification to the company.

Bottom Line

The outlined process demonstrates the effective integration of SAP GTS, SAP S/4HANA, and SAP EWM to meet customs requirements in the goods issue process for exports to third countries This integration enables seamless management of the entire export process, from customer order entry to the export of the goods. Cross-system communication and electronic data transfer with customs authorities ensure efficient and transparent processing, promoting a streamlined business workflow and compliance with the customs regulations.