Know How Transfer

Integration of SAP GTS and SAP EWM in the Goods Receipt Process

SAP Extended Warehouse Management

SAP Global Trade Services

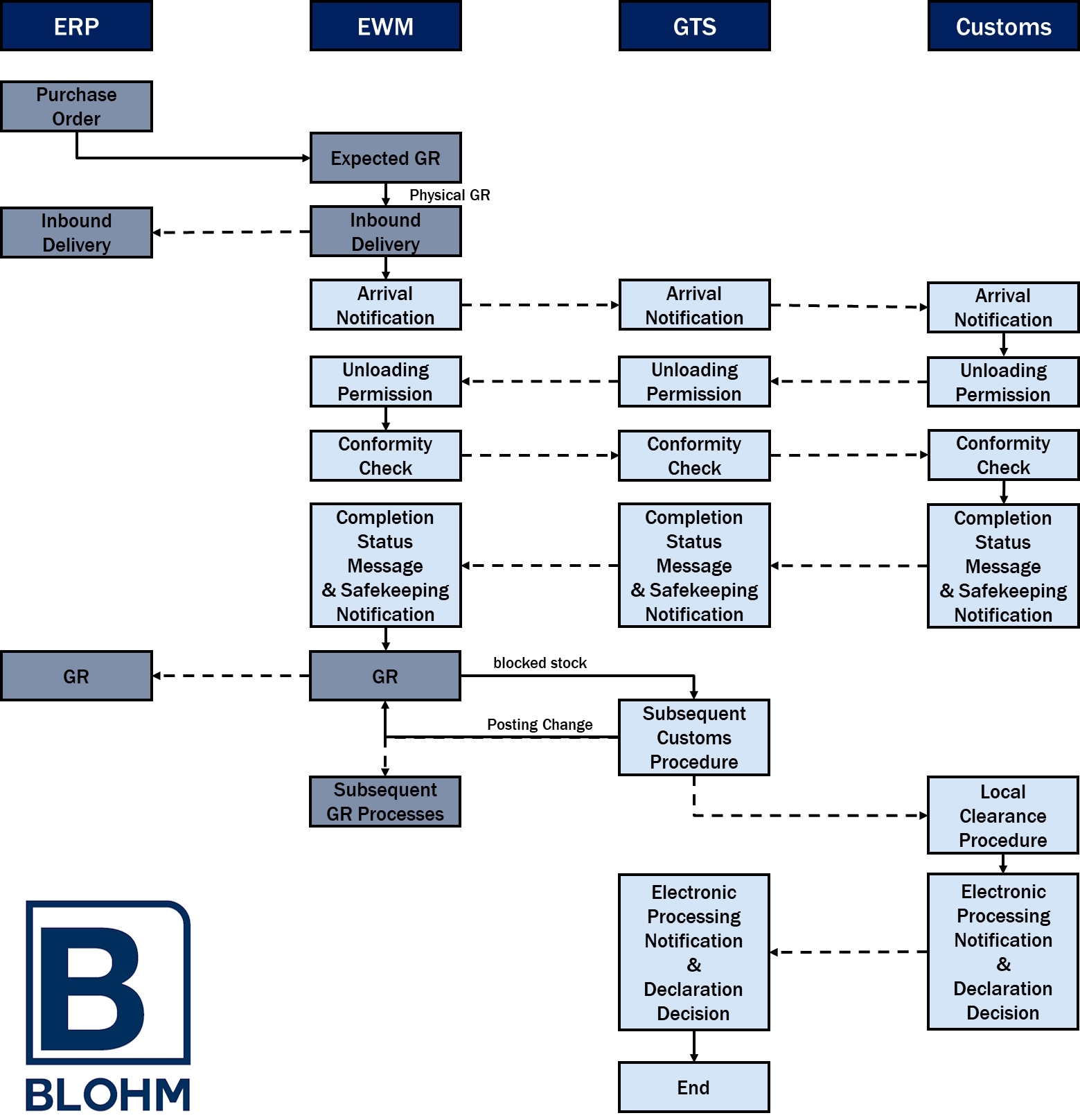

Customs processing is required when receiving goods from a third country. With SAP GTS, companies have the capability to conduct this customs clearance on their own. If a company uses SAP S/4HANA and SAP EWM in addition to SAP GTS, customs procedures can seamlessly integrate into the goods receipt process.

Depending on the agreement with the customs authorities (authorization), companies are allowed to perform some or the entire customs process on their own. If a company holds authorization as an authorized consignee, it can independently present the goods to customs and release them for subsequent customs procedures (e.g., free circulation) within a specified timeframe. To do so, an import customs declaration must be generated, providing the basis for the determination of applicable import duties and taxes by the customs authority.

In this article, we will explain how you can carry out the import process with direct integration of SAP EWM and SAP GTS.

Upstream Process

When goods arrive in the EU from a third country (e.g., when a company places an order with a supplier located in a third country), they undergo customs processing. This involves registering the arrival of the goods after the shipment reaches the EU or the destination country, noting the necessary customs clearance, and assigning a registration number, known as a Movement Reference Number (MRN), for identification purposes. This number serves as the basis for the subsequent import process and communication with the domestic customs authority.

Process Flow with SAP GTS and SAP EWM

The goods receipt process for an import process with the integrated systems SAP S/4HANA, SAP GTS and SAP EWM is as follows:

In diesem idealtypischen Ablauf wird der WE-Prozess unter Verwendung des Erwarteten Wareneingangs in SAP EWM dargestellt. Dieser ist optional; alternativ wird die Anlieferung bereits in SAP ERP bzw. SAP S/4HANA erstellt und ans EWM verteilt. In jedem Fall wird jedoch in der Anlieferung die MRN erfasst und die Anlieferung in SAP EWM auf den Status „In Yard“ gesetzt.

The postings and process flow are explained in detail below.

1. Purchase Order for the Supplier (S/4HANA)

The company places a purchase order for goods with a supplier. The supplier confirms the order and may also advise the delivery.

2. Optional: Expected GR (S/4HANA - EWM)

An expected goods receipt is generated in EWM based on the purchase order. Upon arrival of the goods, an inbound delivery is created referencing the Expected Goods Receipt.

3. Inbound Delivery (EWM - S/4HANA)

As soon as the (import) consignment arrives, the corresponding inbound delivery is created based on the Expected Goods Receipt. Within the inbound delivery, a flag is set to define the consignment as relevant for customs, thereby triggering the subsequent customs process. The quantities and delivery items of the expected goods receipt (as per the purchase order) can be changed when creating the inbound delivery according to the delivery documents. If the (customs) consignment relates to multiple expected goods receipts, multiple inbound deliveries are created.

For consignments requiring clearance, it's crucial to note that unloading from the delivery vehicle is not permitted until the unloading permission (refer to step 5) is obtained from customs.

The EWM inbound delivery is then transmitted to S/4HANA, where it is replicated and visible in the purchase order history. In the event of a partial delivery, the remaining order quantity is appropriately reduced, and an updated Expected Goods Receipt is generated.

4. Arrival Notification (EWM - GTS - Customs)

Das Eintreffen der Sendung muss der Zollbehörde durch eine sogenannte Ankunftsanzeige gemeldet werden. Dies geschieht durch die Erfassung der MRN des Begleitdokuments der Sendung in EWM, die über eine Schnittstelle an GTS zur Übermittlung an den Zoll weitergeleitet wird. Dies geschieht, sobald die Anlieferung in SAP EWM auf den Status „In Yard“ gesetzt wird.

5. Unloading Permission (Customs - GTS - EWM)

Upon reviewing the arrival notification, the customs authority issues an unloading permission, allowing the company to unload the consignment from the delivery vehicle. This permission is transmitted from customs to EWM via GTS.

6. Conformity Check (EWM - GTS - Customs)

Nach dem Entladen der Sendung vom Anlieferfahrzeug muss die Konformität der Zollsendung überprüft werden, indem die Abwicklungsfrist auf dem Begleitdokument sowie die Anzahl der Packstücke überprüft werden. Das Ergebnis der Prüfung wird in EWM erfasst, und die Sendung wird entsprechend als „konform“ oder „nicht konform“ gemeldet.

7. Completion Status Message and Safekeeping Notification (Customs - GTS - EWM)

If the consignment is found to be compliant, customs issues a status message confirming the completion of the transit procedure and sends a safekeeping notification. Consequently, the consignment is considered as presented. Depending on the authorization, it must be temporarily stored until it undergoes a subsequent customs procedure. During this period, the goods must remain unaltered, but activities such as quantity checks or preservation measures such as refrigeration for refrigerated goods are permitted.

8. Goods Receipt (EWM - S/4HANA)

Once the consignment has been checked, the goods receipt for the inbound delivery can be posted. To prevent the products from being altered, such as being used in production or fulfilling customer orders, they are assigned the stock type "blocked stock."

If any discrepancies are found between the physically received goods and the delivery documents, adjustments must be made to the EWM delivery accordingly, as subsequent GTS documents are generated based on this information.

The goods receipt in SAP EWM is then distributed to S/4HANA, where it is visible in the purchase order history.

9. Subsequent Customs Procedure (GTS)

The customs consignment must now be transferred into a subsequent procedure, such as free circulation. In GTS, the consignment is held in a worklist where it can be transferred to a subsequent customs procedure such as the local clearance procedure (depending on the company’s authorization).

Once the subsequent customs procedure is chosen, the goods are considered released (subject to authorization), allowing for unrestricted use from a customs standpoint.

This initiates a stock transfer in EWM (e.g. to quality inspection stock or unrestricted use, based on configuration settings).

Based on the data from the inbound delivery and the selected subsequent procedure, along with the stored authorizations, GTS generates an import customs declaration. This declaration must be reviewed, modified, or supplemented with additional information as needed, before being sent to the customs authorities.

10. Subsequent GR Processes (EWM)

Once the stock posting is completed, the goods receipt processes for the consignment and materials (such as quality inspection, labeling, repackaging, storage, etc.) can be performed.

11. Local Clearence Procedure (GTS - Customs)

When the import customs declaration is transmitted, the customs authority receives the necessary data to determine import duties and taxes.

12. Electronic Processing Notification & Declaration Decision (Customs - GTS)

The customs authority acknowledges receipt of the declaration by sending an electronic processing notification. Following an examination of the declaration, the customs authority issues a decision regarding the declaration, which includes either releasing or blocking the consignment. Upon release, the import process is provisionally completed.

Follow-up Process

Depending on the authorization, the company receives the tax assessment notice either immediately after the declaration decision (refer to step 12) or must prepare a collective supplementary customs declaration for all imports within the corresponding month by month-end, followed by receipt of a collective tax assessment notice.

Bottom Line

The outlined process demonstrates the effective integration of SAP GTS, SAP EWM and SAP S/4HANA to fulfill customs obligations in the goods receipt process for imports from third countries. This integration facilitates smooth management of the entire import process, starting from the supplier's purchase order and ending in the settlement of import duties. Seamless cross-system communication and electronic messaging with customs authorities ensure efficient and transparent processing.